Medicare Advantage Agent Things To Know Before You Get This

Table of ContentsMedicare Advantage Agent - Questions10 Easy Facts About Medicare Advantage Agent ShownSome Known Incorrect Statements About Medicare Advantage Agent The 9-Minute Rule for Medicare Advantage AgentThe Medicare Advantage Agent IdeasFascination About Medicare Advantage Agent

You'll likewise have a copayment if you most likely to the emergency clinic or see a professional. The amounts vary by strategy. is a quantity you pay for a covered service after you have actually satisfied your deductible. It's typically a percent of the cost of the solution. Your health strategy might pay 80 % of the price of a surgery or medical facility stay.

A strategy year is the 12-month duration from the date your coverage began. There are 4 types of major clinical wellness plans in Texas.

Special company (EPO) plans. All 4 kinds are taken care of treatment plans. Handled care strategies limit your option of physicians or encourage you to utilize physicians in their networks.

4 Easy Facts About Medicare Advantage Agent Explained

The plans differ in the degree to which you can utilize doctors outside the network and whether you need to have a medical professional to oversee your treatment. If you don't, you could have to pay the complete price of your care yourself.

If the anesthesiologist runs out your health insurance's network, you will certainly get a shock expense. This is additionally called "balance payment." State and federal regulations protect you from shock clinical expenses. Figure out what bills are covered by shock invoicing regulations on our web page, Exactly how consumers are secured from surprise medical costs To learn more about obtaining assist with a surprise expense, see our web page, Just how to get aid with a surprise clinical costs.

You can utilize this period to sign up with the strategy if you didn't earlier. Plans with higher deductibles, copayments, and coinsurance have lower costs.

Medicare Advantage Agent - An Overview

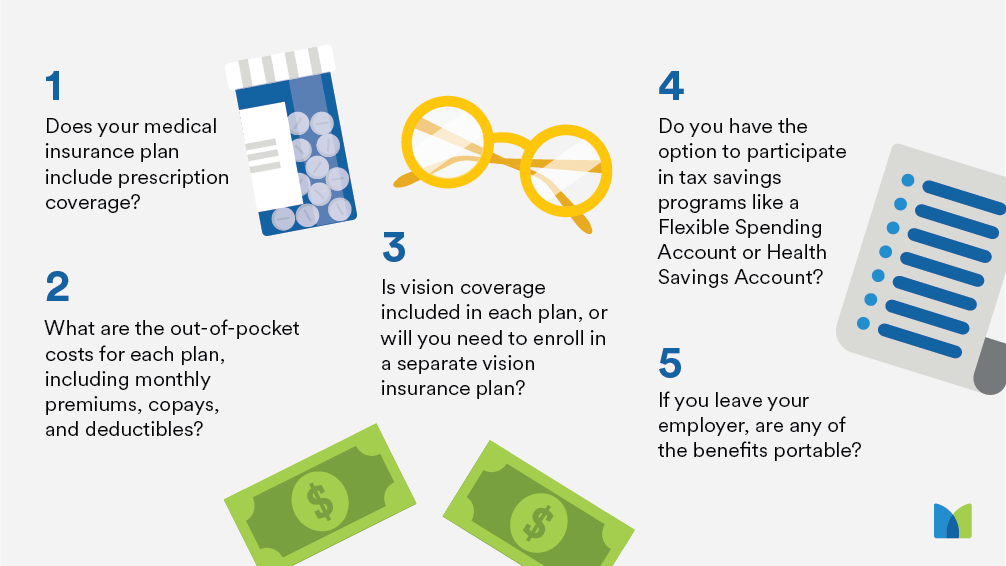

Know what each strategy covers. If you have physicians you desire to maintain, make certain they're in the strategy's network.

Make sure your drugs are on the plan's checklist of authorized medicines. A plan will not pay for drugs that aren't on its listing.

The Texas Life and Health And Wellness Insurance Guaranty Association pays insurance claims for health and wellness insurance. It does not pay cases for HMOs and some various other kinds of strategies.

Your partner and kids likewise can proceed their insurance coverage if you take place Medicare, you and your spouse divorce, or you die. They should have been on your plan for one year or be younger than 1 years of age. Their coverage will end if they get various other protection, don't pay the premiums, or your company quits providing medical insurance.

The Basic Principles Of Medicare Advantage Agent

If you continue your coverage under COBRA, you should pay the costs yourself. Your COBRA protection will certainly be the same as the insurance coverage you had with your company's strategy.

State continuation lets you maintain your insurance coverage also if you can't get COBRA. If you aren't eligible for COBRA, you can continue your coverage with state extension for nine months after your job ends (Medicare Advantage Agent). To obtain state extension, you should have had insurance coverage for the three months before your work finished

If you have a wellness plan via your employer, the employer will have info on your strategy. Review your certification, and keep it convenient to look at when you use wellness services. Be certain you know exactly what your plan covers. Not all health insurance plan cover the very same solutions similarly.

Unknown Facts About Medicare Advantage Agent

It will also inform you if any kind of services have constraints (such as optimum amount that the health insurance will certainly pay for sturdy medical equipment or physical therapy). And it needs to inform what services are not covered whatsoever (such as acupuncture). Do your research, study all the options available, and assess your insurance plan before making any kind of choices.

It should tell you if you require to have the health and wellness strategy license care before you see a company. It ought to likewise tell you: If you need to have the plan license care prior to you see a copyright What to do in situation of an emergency What to do if you are hospitalized Bear in mind, the health insurance might not pay for your services if you do not comply with the correct procedures.

When you have a medical treatment or check out, you normally pay your healthcare provider (physician, healthcare facility, therapist, etc) a co-pay, co-insurance, and/or an insurance deductible to cover your section of the company's expense. like it Medicare Advantage Agent. You anticipate your health insurance plan to pay the remainder of the expense if you are seeing an in-network supplier

All About Medicare Advantage Agent

There are some instances when you could have to file a case on your own. This could occur when you go to an out-of-network service provider, when the copyright does decline your insurance, or when you are taking a trip. If you need to submit your very own health and wellness insurance coverage case, call the number on your insurance card, and the client assistance rep can inform you exactly how to file an insurance claim.

Several wellness plans have a time frame for the length of time you need to file an insurance claim, generally within 90 days of the service. After you submit the claim, the health insurance plan has a minimal time (it varies per state) to inform you or your service provider if the health insurance has actually approved or denied the case.

If it chooses that a service is not medically necessary, the strategy might deny or reduce repayments. For some health insurance plan, this medical requirement decision is made before treatment. For other health check this insurance, the decision is made when the company obtains an expense from the company. The company will certainly send you an explanation of our website advantages that describes the solution, the amount paid, and any added amount for which you might still be liable.